Search Results for author: Cristián Bravo

Found 16 papers, 6 papers with code

Attention-based Dynamic Multilayer Graph Neural Networks for Loan Default Prediction

no code implementations • 1 Feb 2024 • Sahab Zandi, Kamesh Korangi, María Óskarsdóttir, Christophe Mues, Cristián Bravo

We enhance the model by using a custom attention mechanism that weights the different time snapshots according to their importance.

INFLECT-DGNN: Influencer Prediction with Dynamic Graph Neural Networks

1 code implementation • 16 Jul 2023 • Elena Tiukhova, Emiliano Penaloza, María Óskarsdóttir, Bart Baesens, Monique Snoeck, Cristián Bravo

We compare the results of various models to demonstrate the importance of capturing graph representation, temporal dependencies, and using a profit-driven methodology for evaluation.

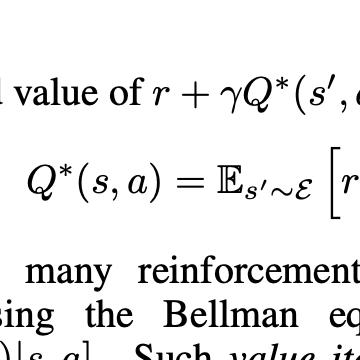

Optimizing Credit Limit Adjustments Under Adversarial Goals Using Reinforcement Learning

no code implementations • 27 Jun 2023 • Sherly Alfonso-Sánchez, Jesús Solano, Alejandro Correa-Bahnsen, Kristina P. Sendova, Cristián Bravo

Second, given the particularities of our problem, we used an offline learning strategy to simulate the impact of the action based on historical data from a super-app in Latin America to train our reinforcement learning agent.

Multi-Modal Deep Learning for Credit Rating Prediction Using Text and Numerical Data Streams

1 code implementation • 21 Apr 2023 • Mahsa Tavakoli, Rohitash Chandra, Fengrui Tian, Cristián Bravo

In this paper, we present an analysis of the most effective architectures for the fusion of deep learning models for the prediction of company credit rating classes, by using structured and unstructured datasets of different types.

Assessment of creditworthiness models privacy-preserving training with synthetic data

no code implementations • 31 Dec 2022 • Ricardo Muñoz-Cancino, Cristián Bravo, Sebastián A. Ríos, Manuel Graña

Credit scoring models are the primary instrument used by financial institutions to manage credit risk.

Influencer Detection with Dynamic Graph Neural Networks

1 code implementation • 15 Nov 2022 • Elena Tiukhova, Emiliano Penaloza, María Óskarsdóttir, Hernan Garcia, Alejandro Correa Bahnsen, Bart Baesens, Monique Snoeck, Cristián Bravo

Leveraging network information for prediction tasks has become a common practice in many domains.

On the dynamics of credit history and social interaction features, and their impact on creditworthiness assessment performance

no code implementations • 13 Apr 2022 • Ricardo Muñoz-Cancino, Cristián Bravo, Sebastián A. Ríos, Manuel Graña

Application scoring is used to decide whether to grant a credit or not, while behavioral scoring is used mainly for portfolio management and to take preventive actions in case of default signals.

Deep residential representations: Using unsupervised learning to unlock elevation data for geo-demographic prediction

no code implementations • 2 Dec 2021 • Matthew Stevenson, Christophe Mues, Cristián Bravo

We consider the suitability of this data not just on its own but also as an auxiliary source of data in combination with demographic features, thus providing a realistic use case for the embeddings.

On the combination of graph data for assessing thin-file borrowers' creditworthiness

no code implementations • 26 Nov 2021 • Ricardo Muñoz-Cancino, Cristián Bravo, Sebastián A. Ríos, Manuel Graña

Here we introduce a framework to improve credit scoring models by blending several Graph Representation Learning methods: feature engineering, graph embeddings, and graph neural networks.

A transformer-based model for default prediction in mid-cap corporate markets

no code implementations • 18 Nov 2021 • Kamesh Korangi, Christophe Mues, Cristián Bravo

In this paper, we study mid-cap companies, i. e. publicly traded companies with less than US $10 billion in market capitalisation.

Improving healthcare access management by predicting patient no-show behaviour

1 code implementation • 10 Dec 2020 • David Barrera Ferro, Sally Brailsford, Cristián Bravo, Honora Smith

In this context many researchers have used multiple regression models to identify patient and appointment characteristics than can be used as good predictors for no-show probabilities.

Multilayer Network Analysis for Improved Credit Risk Prediction

1 code implementation • 19 Oct 2020 • María Óskarsdóttir, Cristián Bravo

We present a multilayer network model for credit risk assessment.

Evolution of Credit Risk Using a Personalized Pagerank Algorithm for Multilayer Networks

1 code implementation • 25 May 2020 • Cristián Bravo, María Óskarsdóttir

Our personalized PageRank algorithm for multilayer networks allows for quantifying how credit risk evolves across time and propagates through these networks.

Super-App Behavioral Patterns in Credit Risk Models: Financial, Statistical and Regulatory Implications

no code implementations • 9 May 2020 • Luisa Roa, Alejandro Correa-Bahnsen, Gabriel Suarez, Fernando Cortés-Tejada, María A. Luque, Cristián Bravo

In this paper we present the impact of alternative data that originates from an app-based marketplace, in contrast to traditional bureau data, upon credit scoring models.

The value of text for small business default prediction: A deep learning approach

no code implementations • 19 Mar 2020 • Matthew Stevenson, Christophe Mues, Cristián Bravo

Compared to consumer lending, Micro, Small and Medium Enterprise (mSME) credit risk modelling is particularly challenging, as, often, the same sources of information are not available.

The Value of Big Data for Credit Scoring: Enhancing Financial Inclusion using Mobile Phone Data and Social Network Analytics

no code implementations • 23 Feb 2020 • María Óskarsdóttir, Cristián Bravo, Carlos Sarraute, Jan Vanthienen, Bart Baesens

In terms of profit, the best model is the one built with only calling behavior features.