Search Results for author: Igor Halperin

Found 11 papers, 2 papers with code

Model-Free Market Risk Hedging Using Crowding Networks

no code implementations • 13 Jun 2023 • Vadim Zlotnikov, Jiayu Liu, Igor Halperin, Fei He, Lisa Huang

Crowding is widely regarded as one of the most important risk factors in designing portfolio strategies.

Phases of MANES: Multi-Asset Non-Equilibrium Skew Model of a Strongly Non-Linear Market with Phase Transitions

no code implementations • 14 Mar 2022 • Igor Halperin

This paper presents an analytically tractable and practically-oriented model of non-linear dynamics of a multi-asset market in the limit of a large number of assets.

Combining Reinforcement Learning and Inverse Reinforcement Learning for Asset Allocation Recommendations

no code implementations • 6 Jan 2022 • Igor Halperin, Jiayu Liu, Xiao Zhang

We suggest a simple practical method to combine the human and artificial intelligence to both learn best investment practices of fund managers, and provide recommendations to improve them.

Distributional Offline Continuous-Time Reinforcement Learning with Neural Physics-Informed PDEs (SciPhy RL for DOCTR-L)

no code implementations • 2 Apr 2021 • Igor Halperin

A data-driven solution of the soft HJB equation uses methods of Neural PDEs and Physics-Informed Neural Networks developed in the field of Scientific Machine Learning (SciML).

Non-Equilibrium Skewness, Market Crises, and Option Pricing: Non-Linear Langevin Model of Markets with Supersymmetry

no code implementations • 3 Nov 2020 • Igor Halperin

Borrowing ideas from supersymmetric quantum mechanics (SUSY QM), a parameterized ground state wave function (WF) of this QM system is used as a direct input to the model, which also fixes a non-linear Langevin potential.

The Inverted Parabola World of Classical Quantitative Finance: Non-Equilibrium and Non-Perturbative Finance Perspective

no code implementations • 9 Aug 2020 • Igor Halperin

Classical quantitative finance models such as the Geometric Brownian Motion or its later extensions such as local or stochastic volatility models do not make sense when seen from a physics-based perspective, as they are all equivalent to a negative mass oscillator with a noise.

G-Learner and GIRL: Goal Based Wealth Management with Reinforcement Learning

no code implementations • 25 Feb 2020 • Matthew Dixon, Igor Halperin

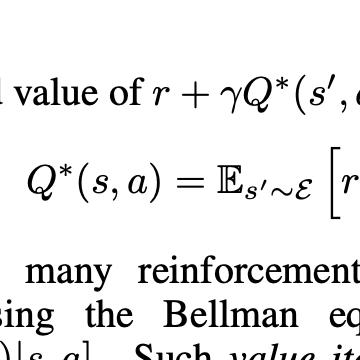

Our approach is based on G-learning - a probabilistic extension of the Q-learning method of reinforcement learning.

Market Self-Learning of Signals, Impact and Optimal Trading: Invisible Hand Inference with Free Energy

1 code implementation • 16 May 2018 • Igor Halperin, Ilya Feldshteyn

In particular, it represents, in a simple modeling framework, market views of common predictive signals, market impacts and implied optimal dynamic portfolio allocations, and can be used to assess values of private signals.

The QLBS Q-Learner Goes NuQLear: Fitted Q Iteration, Inverse RL, and Option Portfolios

no code implementations • 17 Jan 2018 • Igor Halperin

It combines the famous Q-Learning method for RL with the Black-Scholes (-Merton) model's idea of reducing the problem of option pricing and hedging to the problem of optimal rebalancing of a dynamic replicating portfolio for the option, which is made of a stock and cash.

QLBS: Q-Learner in the Black-Scholes(-Merton) Worlds

1 code implementation • 13 Dec 2017 • Igor Halperin

This paper presents a discrete-time option pricing model that is rooted in Reinforcement Learning (RL), and more specifically in the famous Q-Learning method of RL.

Inverse Reinforcement Learning for Marketing

no code implementations • 13 Dec 2017 • Igor Halperin

Learning customer preferences from an observed behaviour is an important topic in the marketing literature.