Search Results for author: Julian Sester

Found 12 papers, 8 papers with code

Measuring Name Concentrations through Deep Learning

no code implementations • 25 Mar 2024 • Eva Lütkebohmert, Julian Sester

We propose a new deep learning approach for the quantification of name concentration risk in loan portfolios.

On the Relevance and Appropriateness of Name Concentration Risk Adjustments for Portfolios of Multilateral Development Banks

no code implementations • 23 Nov 2023 • Eva Lütkebohmert, Julian Sester, Hongyi Shen

Sovereign loan portfolios of Multilateral Development Banks (MDBs) typically consist of only a small number of borrowers and hence are heavily exposed to single name concentration risk.

On intermediate Marginals in Martingale Optimal Transportation

no code implementations • 19 Jul 2023 • Julian Sester

We study the influence of additional intermediate marginal distributions on the value of the martingale optimal transport problem.

Neural networks can detect model-free static arbitrage strategies

1 code implementation • 19 Jun 2023 • Ariel Neufeld, Julian Sester

In this paper we demonstrate both theoretically as well as numerically that neural networks can detect model-free static arbitrage opportunities whenever the market admits some.

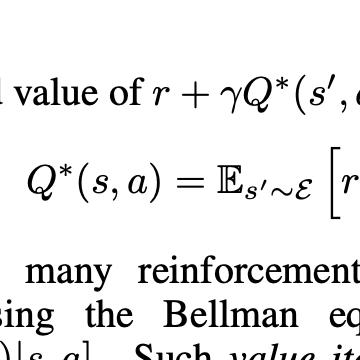

Robust $Q$-learning Algorithm for Markov Decision Processes under Wasserstein Uncertainty

1 code implementation • 30 Sep 2022 • Ariel Neufeld, Julian Sester

We present a novel $Q$-learning algorithm to solve distributionally robust Markov decision problems, where the corresponding ambiguity set of transition probabilities for the underlying Markov decision process is a Wasserstein ball around a (possibly estimated) reference measure.

Markov Decision Processes under Model Uncertainty

1 code implementation • 13 Jun 2022 • Ariel Neufeld, Julian Sester, Mario Šikić

We introduce a general framework for Markov decision problems under model uncertainty in a discrete-time infinite horizon setting.

Improved Robust Price Bounds for Multi-Asset Derivatives under Market-Implied Dependence Information

1 code implementation • 3 Apr 2022 • Jonathan Ansari, Eva Lütkebohmert, Ariel Neufeld, Julian Sester

We show how inter-asset dependence information derived from market prices of options can lead to improved model-free price bounds for multi-asset derivatives.

Detecting data-driven robust statistical arbitrage strategies with deep neural networks

1 code implementation • 7 Mar 2022 • Ariel Neufeld, Julian Sester, Daiying Yin

We present an approach, based on deep neural networks, that allows identifying robust statistical arbitrage strategies in financial markets.

Robust deep hedging

1 code implementation • 18 Jun 2021 • Eva Lütkebohmert, Thorsten Schmidt, Julian Sester

We study pricing and hedging under parameter uncertainty for a class of Markov processes which we call generalized affine processes and which includes the Black-Scholes model as well as the constant elasticity of variance (CEV) model as special cases.

A deep learning approach to data-driven model-free pricing and to martingale optimal transport

1 code implementation • 21 Mar 2021 • Ariel Neufeld, Julian Sester

We introduce a novel and highly tractable supervised learning approach based on neural networks that can be applied for the computation of model-free price bounds of, potentially high-dimensional, financial derivatives and for the determination of optimal hedging strategies attaining these bounds.

On the stability of the martingale optimal transport problem: A set-valued map approach

no code implementations • 4 Feb 2021 • Ariel Neufeld, Julian Sester

its marginals was recently established in Backhoff-Veraguas and Pammer [2] and Wiesel [21].

Probability Optimization and Control Mathematical Finance

Model-free price bounds under dynamic option trading

1 code implementation • 4 Jan 2021 • Ariel Neufeld, Julian Sester

In this paper we extend discrete time semi-static trading strategies by also allowing for dynamic trading in a finite amount of options, and we study the consequences for the model-independent super-replication prices of exotic derivatives.