Exploring investor behavior in Bitcoin: a study of the disposition effect

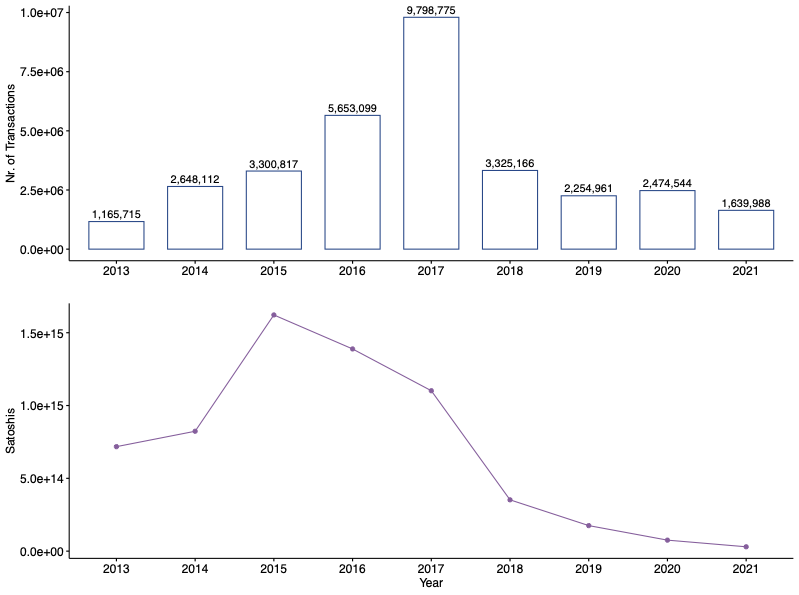

Investors commonly exhibit the disposition effect - the irrational tendency to sell their winning investments and hold onto their losing ones. While this phenomenon has been observed in many traditional markets, it remains unclear whether it also applies to atypical markets like cryptoassets. This paper investigates the prevalence of the disposition effect in Bitcoin using transactions targeting cryptoasset exchanges as proxies for selling transactions. Our findings suggest that investors in Bitcoin were indeed subject to the disposition effect, with varying intensity. They also show that the disposition effect was not consistently present throughout the observation period. Its prevalence was more evident from the boom and bust year 2017 onwards, as confirmed by various technical indicators. Our study suggests irrational investor behavior is also present in atypical markets like Bitcoin.

PDF Abstract