Deep Hedging

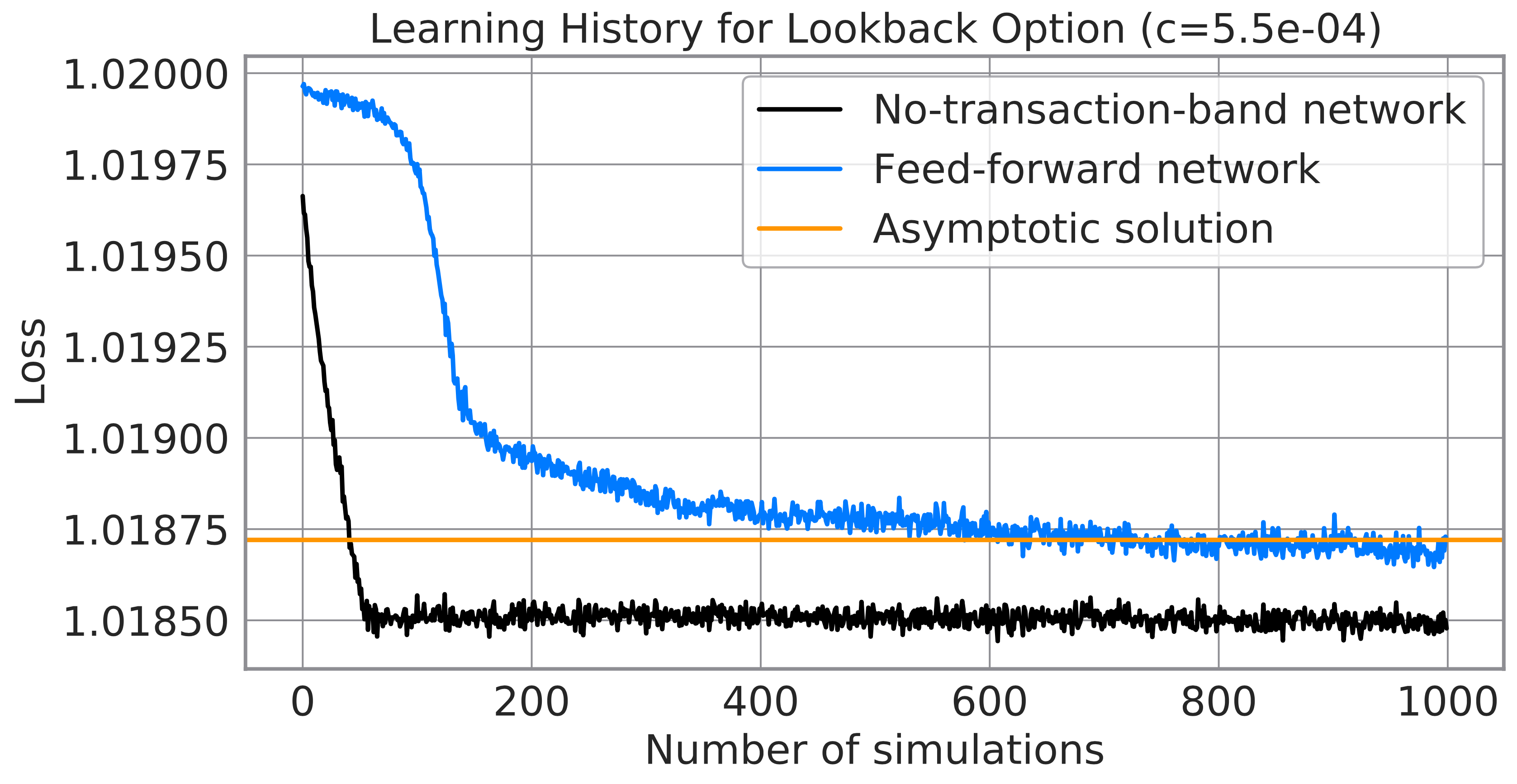

We present a framework for hedging a portfolio of derivatives in the presence of market frictions such as transaction costs, market impact, liquidity constraints or risk limits using modern deep reinforcement machine learning methods. We discuss how standard reinforcement learning methods can be applied to non-linear reward structures, i.e. in our case convex risk measures. As a general contribution to the use of deep learning for stochastic processes, we also show that the set of constrained trading strategies used by our algorithm is large enough to $\epsilon$-approximate any optimal solution. Our algorithm can be implemented efficiently even in high-dimensional situations using modern machine learning tools. Its structure does not depend on specific market dynamics, and generalizes across hedging instruments including the use of liquid derivatives. Its computational performance is largely invariant in the size of the portfolio as it depends mainly on the number of hedging instruments available. We illustrate our approach by showing the effect on hedging under transaction costs in a synthetic market driven by the Heston model, where we outperform the standard "complete market" solution.

PDF Abstract