Modelling Stock-market Investors as Reinforcement Learning Agents [Correction]

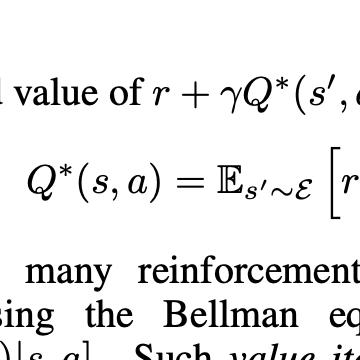

Decision making in uncertain and risky environments is a prominent area of research. Standard economic theories fail to fully explain human behaviour, while a potentially promising alternative may lie in the direction of Reinforcement Learning (RL) theory. We analyse data for 46 players extracted from a financial market online game and test whether Reinforcement Learning (Q-Learning) could capture these players behaviour using a risk measure based on financial modeling. Moreover we test an earlier hypothesis that players are "na\"ive" (short-sighted). Our results indicate that a simple Reinforcement Learning model which considers only the selling component of the task captures the decision-making process for a subset of players but this is not sufficient to draw any conclusion on the population. We also find that there is not a significant improvement of fitting of the players when using a full RL model against a myopic version, where only immediate reward is valued by the players. This indicates that players, if using a Reinforcement Learning approach, do so na\"ively

PDF Abstract