Nonparametric Bayesian volatility estimation

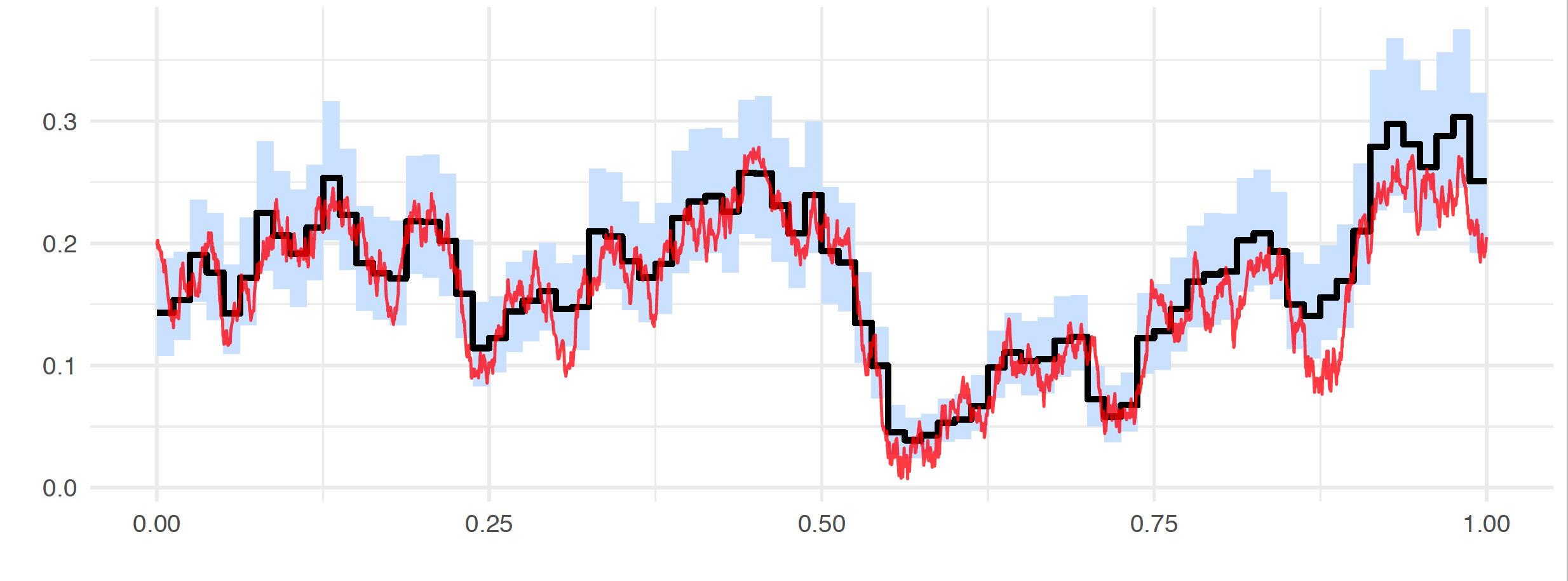

Given discrete time observations over a fixed time interval, we study a nonparametric Bayesian approach to estimation of the volatility coefficient of a stochastic differential equation. We postulate a histogram-type prior on the volatility with piecewise constant realisations on bins forming a partition of the time interval. The values on the bins are assigned an inverse Gamma Markov chain (IGMC) prior. Posterior inference is straightforward to implement via Gibbs sampling, as the full conditional distributions are available explicitly and turn out to be inverse Gamma. We also discuss in detail the hyperparameter selection for our method. Our nonparametric Bayesian approach leads to good practical results in representative simulation examples. Finally, we apply it on a classical data set in change-point analysis: weekly closings of the Dow-Jones industrial averages.

PDF Abstract