Search Results for author: Matthew Dixon

Found 7 papers, 2 papers with code

Beyond Surrogate Modeling: Learning the Local Volatility Via Shape Constraints

1 code implementation • 20 Dec 2022 • Marc Chataigner, Areski Cousin, Stéphane Crépey, Matthew Dixon, Djibril Gueye

We explore the abilities of two machine learning approaches for no-arbitrage interpolation of European vanilla option prices, which jointly yield the corresponding local volatility surface: a finite dimensional Gaussian process (GP) regression approach under no-arbitrage constraints based on prices, and a neural net (NN) approach with penalization of arbitrages based on implied volatilities.

A Unified Bayesian Framework for Pricing Catastrophe Bond Derivatives

no code implementations • 9 May 2022 • Dixon Domfeh, Arpita Chatterjee, Matthew Dixon

Catastrophe (CAT) bond markets are incomplete and hence carry uncertainty in instrument pricing.

MS-nowcasting: Operational Precipitation Nowcasting with Convolutional LSTMs at Microsoft Weather

no code implementations • 18 Nov 2021 • Sylwester Klocek, Haiyu Dong, Matthew Dixon, Panashe Kanengoni, Najeeb Kazmi, Pete Luferenko, Zhongjian Lv, Shikhar Sharma, Jonathan Weyn, Siqi Xiang

We present the encoder-forecaster convolutional long short-term memory (LSTM) deep-learning model that powers Microsoft Weather's operational precipitation nowcasting product.

Deep Local Volatility

1 code implementation • 20 Jul 2020 • Marc Chataigner, Stéphane Crépey, Matthew Dixon

Deep learning for option pricing has emerged as a novel methodology for fast computations with applications in calibration and computation of Greeks.

G-Learner and GIRL: Goal Based Wealth Management with Reinforcement Learning

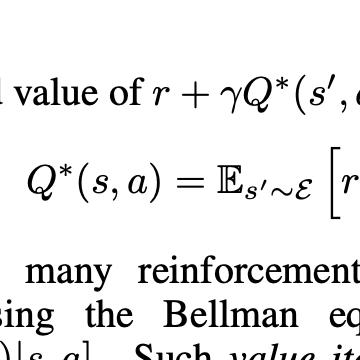

no code implementations • 25 Feb 2020 • Matthew Dixon, Igor Halperin

Our approach is based on G-learning - a probabilistic extension of the Q-learning method of reinforcement learning.

OSTSC: Over Sampling for Time Series Classification in R

no code implementations • 27 Nov 2017 • Matthew Dixon, Diego Klabjan, Lan Wei

The OSTSC package is a powerful oversampling approach for classifying univariant, but multinomial time series data in R. This article provides a brief overview of the oversampling methodology implemented by the package.

Classification-based Financial Markets Prediction using Deep Neural Networks

no code implementations • 29 Mar 2016 • Matthew Dixon, Diego Klabjan, Jin Hoon Bang

Deep neural networks (DNNs) are powerful types of artificial neural networks (ANNs) that use several hidden layers.