Search Results for author: Tim Gebbie

Found 21 papers, 12 papers with code

Epistemic Limits of Empirical Finance: Causal Reductionism and Self-Reference

no code implementations • 28 Nov 2023 • Daniel Polakow, Tim Gebbie, Emlyn Flint

The clarion call for causal reduction in the study of capital markets is intensifying.

Anomalous diffusion and price impact in the fluid-limit of an order book

no code implementations • 9 Oct 2023 • Derick Diana, Tim Gebbie

Concretely, we demonstrate the price impact for flash limit-orders and market orders and show how the numerical method generate kinks in the price impact.

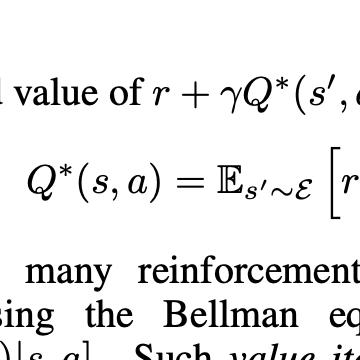

Variations on the Reinforcement Learning performance of Blackjack

1 code implementation • 9 Aug 2023 • Avish Buramdoyal, Tim Gebbie

Blackjack or "21" is a popular card-based game of chance and skill.

Many learning agents interacting with an agent-based market model

no code implementations • 13 Mar 2023 • Matthew Dicks, Andrew Paskaramoorthy, Tim Gebbie

Further, we examine whether the inclusion of optimal execution agents that can learn is able to produce dynamics with the same complexity as empirical data.

A simple learning agent interacting with an agent-based market model

1 code implementation • 22 Aug 2022 • Matthew Dicks, Andrew Paskaramoorthy, Tim Gebbie

We consider the learning dynamics of a single reinforcement learning optimal execution trading agent when it interacts with an event driven agent-based financial market model.

Simulation and estimation of an agent-based market-model with a matching engine

2 code implementations • 17 Aug 2021 • Ivan Jericevich, Patrick Chang, Tim Gebbie

This is possible when agent-based model interactions occur asynchronously via order matching using a matching engine in event time to replace sequential calendar time market clearing.

Geometric insights into robust portfolio construction

no code implementations • 13 Jul 2021 • Lara Dalmeyer, Tim Gebbie

We investigate and extend the results of Golts and Jones (2009) that an $\alpha$-weight angle resulting from unconstrained quadratic portfolio optimisations has an upper bound dependent on the condition number of the covariance matrix.

The efficient frontiers of mean-variance portfolio rules under distribution misspecification

no code implementations • 19 Jun 2021 • Andrew Paskaramoorthy, Tim Gebbie, Terence van Zyl

Mean-variance portfolio decisions that combine prediction and optimisation have been shown to have poor empirical performance.

Simulation and estimation of a point-process market-model with a matching engine

1 code implementation • 5 May 2021 • Ivan Jericevich, Patrick Chang, Tim Gebbie

Here we consider a 10-variate Hawkes process with simple rules to simulate common order types which are submitted to a matching engine.

Calibrating an adaptive Farmer-Joshi agent-based model for financial markets

no code implementations • 20 Apr 2021 • Ivan Jericevich, Murray McKechnie, Tim Gebbie

We replicate the contested calibration of the Farmer and Joshi agent based model of financial markets using a genetic algorithm and a Nelder-Mead with threshold accepting algorithm following Fabretti.

The Epps effect under alternative sampling schemes

1 code implementation • 23 Nov 2020 • Patrick Chang, Etienne Pienaar, Tim Gebbie

Concretely, we find that the Epps effect is present under all three definitions of time and that correlations emerge faster under trade time compared to calendar time, whereas correlations emerge linearly under volume time.

Learning low-frequency temporal patterns for quantitative trading

1 code implementation • 12 Aug 2020 • Joel da Costa, Tim Gebbie

The framework is proved on daily sampled closing time-series data from JSE equity markets.

Using the Epps effect to detect discrete processes

2 code implementations • 21 May 2020 • Patrick Chang, Etienne Pienaar, Tim Gebbie

The Epps effect is key phenomenology relating to high frequency correlation dynamics in financial markets.

A Framework for Online Investment Algorithms

1 code implementation • 30 Mar 2020 • Andrew Paskaramoorthy, Terence van Zyl, Tim Gebbie

This article provides a workflow that can in-turn be embedded into a process level learning framework.

Malliavin-Mancino estimators implemented with non-uniform fast Fourier transforms

2 code implementations • 5 Mar 2020 • Patrick Chang, Etienne Pienaar, Tim Gebbie

We implement and test kernel averaging Non-Uniform Fast Fourier Transform (NUFFT) methods to enhance the performance of correlation and covariance estimation on asynchronously sampled event-data using the Malliavin-Mancino Fourier estimator.

Revisiting the Epps effect using volume time averaging: An exercise in R

no code implementations • 5 Dec 2019 • Patrick Chang, Roger Bukuru, Tim Gebbie

We revisit and demonstrate the Epps effect using two well-known non-parametric covariance estimators; the Malliavin and Mancino (MM), and Hayashi and Yoshida (HY) estimators.

Systematic Asset Allocation using Flexible Views for South African Markets

no code implementations • 12 Oct 2019 • Ann Sebastian, Tim Gebbie

The HS-FP framework is a flexible non-parametric estimation approach that considers future asset class behavior to be conditional on time and market environments, and derives a forward looking distribution that is consistent with this view while remaining close as possible to the prior distribution.

Agglomerative Likelihood Clustering

5 code implementations • 2 Aug 2019 • Lionel Yelibi, Tim Gebbie

We consider the problem of fast time-series data clustering.

Learning the dynamics of technical trading strategies

1 code implementation • 6 Mar 2019 • Nicholas Murphy, Tim Gebbie

A key contribution is that the overall aggregated trading strategies are tested for statistical arbitrage using a novel hypothesis test proposed by Jarrow et al. (2012) on both daily sampled and intraday time-scales.

Fast Super-Paramagnetic Clustering

2 code implementations • 5 Oct 2018 • Lionel Yelibi, Tim Gebbie

We map stock market interactions to spin models to recover their hierarchical structure using a simulated annealing based Super-Paramagnetic Clustering (SPC) algorithm.

High-speed detection of emergent market clustering via an unsupervised parallel genetic algorithm

no code implementations • 17 Mar 2014 • Dieter Hendricks, Diane Wilcox, Tim Gebbie

We implement a master-slave parallel genetic algorithm (PGA) with a bespoke log-likelihood fitness function to identify emergent clusters within price evolutions.