A Bayesian take on option pricing with Gaussian processes

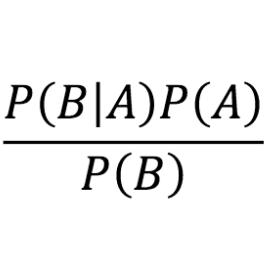

Local volatility is a versatile option pricing model due to its state dependent diffusion coefficient. Calibration is, however, non-trivial as it involves both proposing a hypothesis model of the latent function and a method for fitting it to data. In this paper we present novel Bayesian inference with Gaussian process priors. We obtain a rich representation of the local volatility function with a probabilistic notion of uncertainty attached to the calibrate. We propose an inference algorithm and apply our approach to S&P 500 market data.

PDF AbstractDatasets

Add Datasets

introduced or used in this paper

Results from the Paper

Submit

results from this paper

to get state-of-the-art GitHub badges and help the

community compare results to other papers.