Modeling Financial Time Series using LSTM with Trainable Initial Hidden States

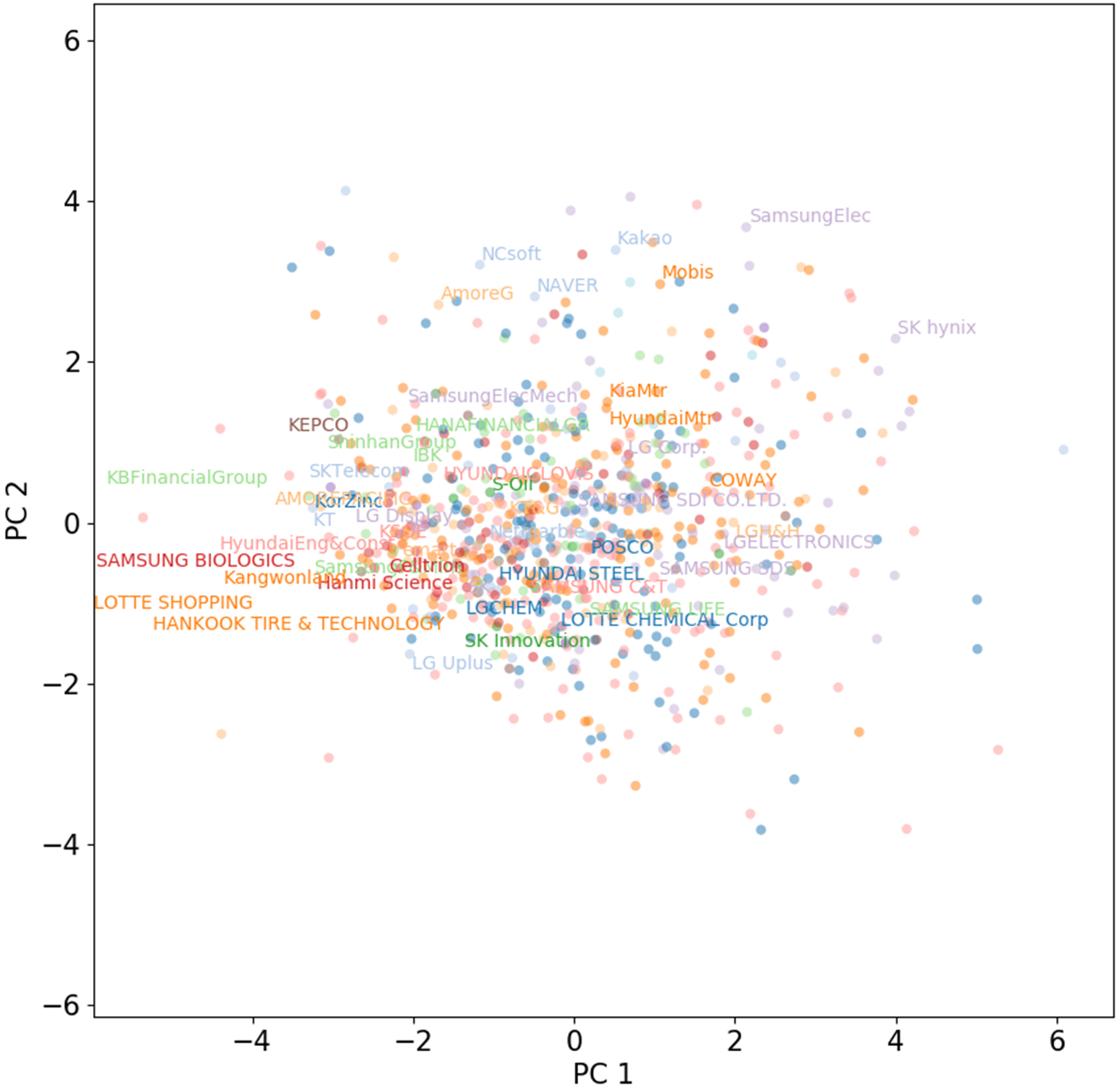

Extracting previously unknown patterns and information in time series is central to many real-world applications. In this study, we introduce a novel approach to modeling financial time series using a deep learning model. We use a Long Short-Term Memory (LSTM) network equipped with the trainable initial hidden states. By learning to reconstruct time series, the proposed model can represent high-dimensional time series data with its parameters. An experiment with the Korean stock market data showed that the model was able to capture the relative similarity between a large number of stock prices in its latent space. Besides, the model was also able to predict the future stock trends from the latent space. The proposed method can help to identify relationships among many time series, and it could be applied to financial applications, such as optimizing the investment portfolios.

PDF Abstract