Nonparametric Bayesian volatility learning under microstructure noise

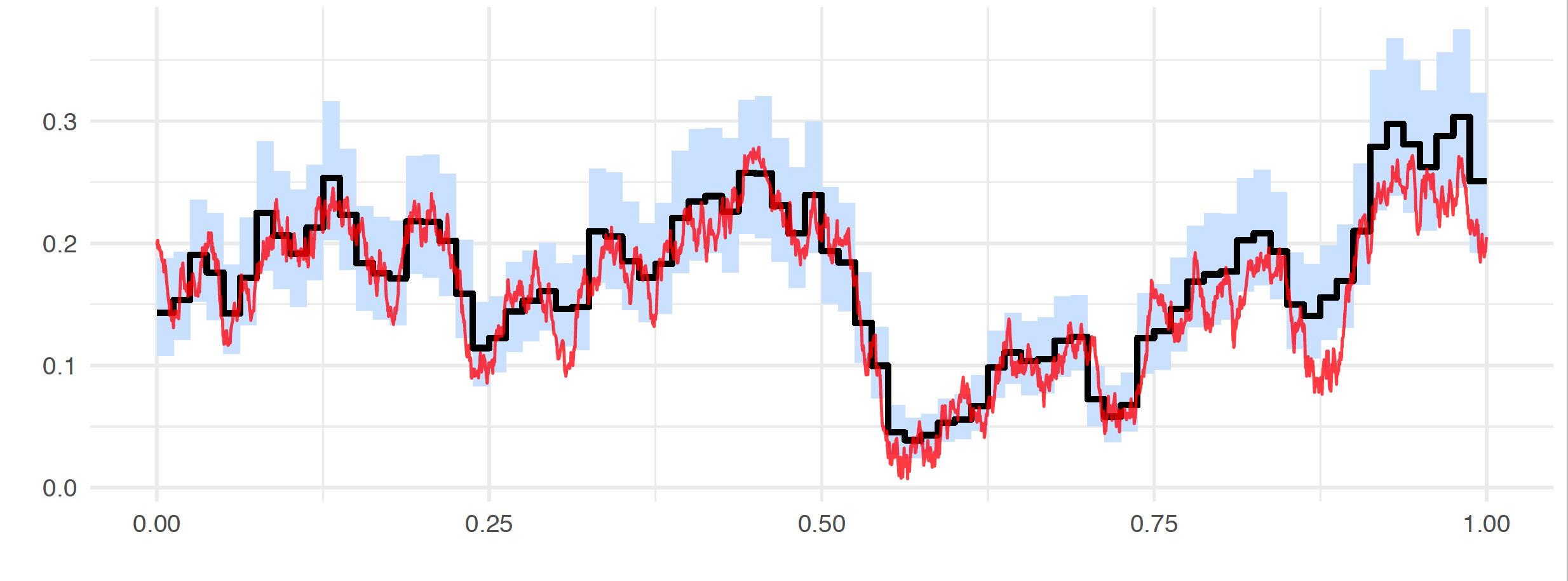

In this work, we study the problem of learning the volatility under market microstructure noise. Specifically, we consider noisy discrete time observations from a stochastic differential equation and develop a novel computational method to learn the diffusion coefficient of the equation. We take a nonparametric Bayesian approach, where we \emph{a priori} model the volatility function as piecewise constant. Its prior is specified via the inverse Gamma Markov chain. Sampling from the posterior is accomplished by incorporating the Forward Filtering Backward Simulation algorithm in the Gibbs sampler. Good performance of the method is demonstrated on two representative synthetic data examples. We also apply the method on a EUR/USD exchange rate dataset. Finally we present a limit result on the prior distribution.

PDF Abstract