Parameters identification for an inverse problem arising from a binary option using a Bayesian inference approach

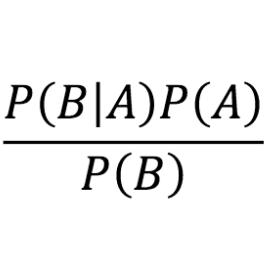

No--arbitrage property provides a simple method for pricing financial derivatives. However, arbitrage opportunities exist among different markets in various fields, even for a very short time. By knowing that an arbitrage property exists, we can adopt a financial trading strategy. This paper investigates the inverse option problems (IOP) in the extended Black--Scholes model. We identify the model coefficients from the measured data and attempt to find arbitrage opportunities in different financial markets using a Bayesian inference approach, which is presented as an IOP solution. The posterior probability density function of the parameters is computed from the measured data.The statistics of the unknown parameters are estimated by a Markov Chain Monte Carlo (MCMC) algorithm, which exploits the posterior state space. The efficient sampling strategy of the MCMC algorithm enables us to solve inverse problems by the Bayesian inference technique. Our numerical results indicate that the Bayesian inference approach can simultaneously estimate the unknown trend and volatility coefficients from the measured data.

PDF Abstract