Select and Trade: Towards Unified Pair Trading with Hierarchical Reinforcement Learning

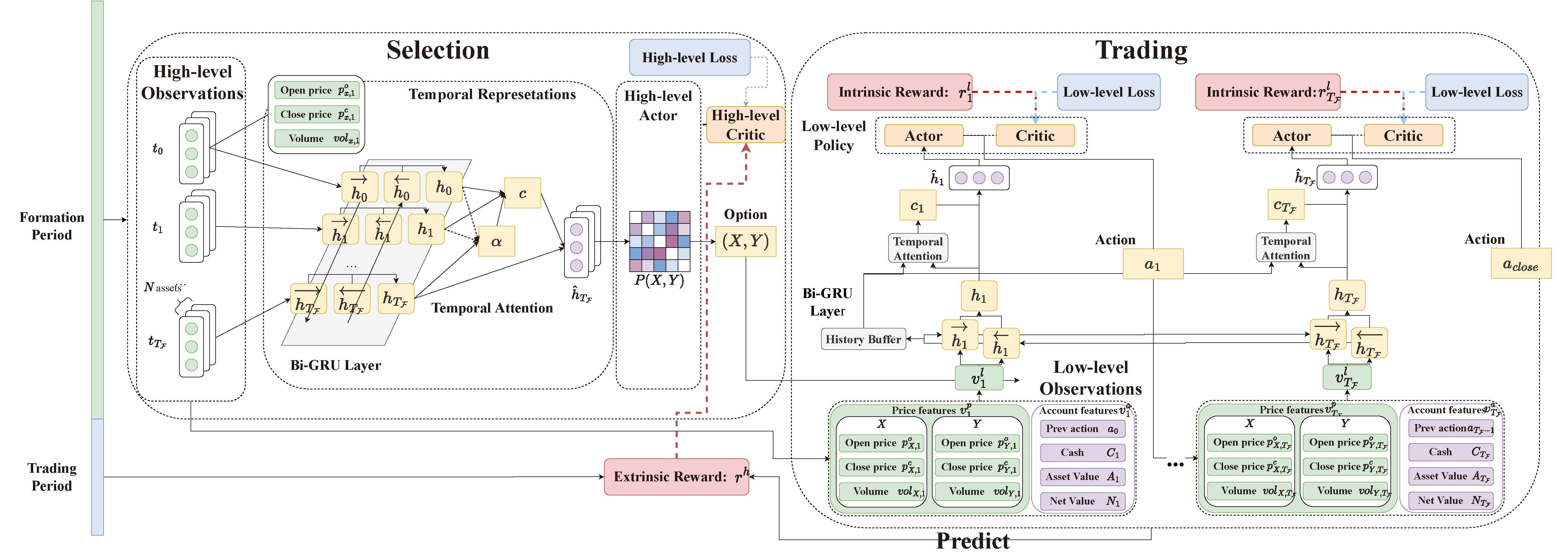

Pair trading is one of the most effective statistical arbitrage strategies which seeks a neutral profit by hedging a pair of selected assets. Existing methods generally decompose the task into two separate steps: pair selection and trading. However, the decoupling of two closely related subtasks can block information propagation and lead to limited overall performance. For pair selection, ignoring the trading performance results in the wrong assets being selected with irrelevant price movements, while the agent trained for trading can overfit to the selected assets without any historical information of other assets. To address it, in this paper, we propose a paradigm for automatic pair trading as a unified task rather than a two-step pipeline. We design a hierarchical reinforcement learning framework to jointly learn and optimize two subtasks. A high-level policy would select two assets from all possible combinations and a low-level policy would then perform a series of trading actions. Experimental results on real-world stock data demonstrate the effectiveness of our method on pair trading compared with both existing pair selection and trading methods.

PDF Abstract

S&P 500 Pair Trading

S&P 500 Pair Trading

CSI 300 Pair Trading

CSI 300 Pair Trading