Search Results for author: Charles-Albert Lehalle

Found 6 papers, 1 papers with code

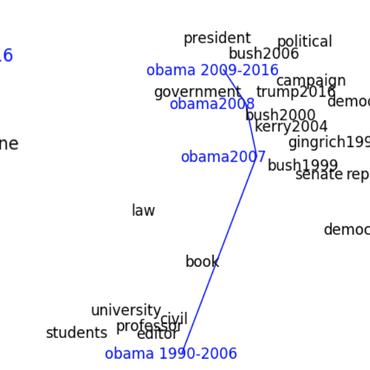

Do Word Embeddings Really Understand Loughran-McDonald's Polarities?

no code implementations • 17 Mar 2021 • Mengda Li, Charles-Albert Lehalle

That for, we rely on the Loughran-McDonald Sentiment Word Lists largely used on financial texts and we show that embeddings are exposed to mixing terms with opposite polarity, because of the way they can treat antonyms as frequentist synonyms.

Phase Transitions in Kyle's Model with Market Maker Profit Incentives

no code implementations • 7 Mar 2021 • Charles-Albert Lehalle, Eyal Neuman, Segev Shlomov

In addition to the classical framework, a revenue term is added to the market maker's performance function, which is proportional to the order flow and to the size of the bid-ask spread.

Learning a functional control for high-frequency finance

no code implementations • 17 Jun 2020 • Laura Leal, Mathieu Laurière, Charles-Albert Lehalle

The issue of scarcity of financial data is solved by transfer learning: the neural network is first trained on trajectories generated thanks to a Monte-Carlo scheme, leading to a good initialization before training on historical trajectories.

Improving reinforcement learning algorithms: towards optimal learning rate policies

1 code implementation • 6 Nov 2019 • Othmane Mounjid, Charles-Albert Lehalle

In the outer level, we propose an optimal methodology for the selection of the predefined sequence $(\gamma^o_k)_{k\geq 0}$.

Transaction Cost Analytics for Corporate Bonds

no code implementations • 21 Mar 2019 • Xin Guo, Charles-Albert Lehalle, Renyuan Xu

This part is on the time scale of each transaction of liquid corporate bonds, and is by applying a transient impact model to estimate the price impact kernel using a non-parametric method.

Optimal posting price of limit orders: learning by trading

no code implementations • 11 Dec 2011 • Sophie Laruelle, Charles-Albert Lehalle, Gilles Pagès

Considering that a trader or a trading algorithm interacting with markets during continuous auctions can be modeled by an iterating procedure adjusting the price at which he posts orders at a given rhythm, this paper proposes a procedure minimizing his costs.

Trading and Market Microstructure Probability