Search Results for author: Philip Treleaven

Found 9 papers, 1 papers with code

Limit Order Book Simulations: A Review

no code implementations • 27 Feb 2024 • Konark Jain, Nick Firoozye, Jonathan Kochems, Philip Treleaven

Limit Order Books (LOBs) serve as a mechanism for buyers and sellers to interact with each other in the financial markets.

Limit Order Book Dynamics and Order Size Modelling Using Compound Hawkes Process

no code implementations • 14 Dec 2023 • Konark Jain, Nick Firoozye, Jonathan Kochems, Philip Treleaven

We propose a novel methodology of using Compound Hawkes Process for the LOB where each event has an order size sampled from a calibrated distribution.

Cultural Alignment in Large Language Models: An Explanatory Analysis Based on Hofstede's Cultural Dimensions

no code implementations • 25 Aug 2023 • Reem I. Masoud, Ziquan Liu, Martin Ferianc, Philip Treleaven, Miguel Rodrigues

The deployment of large language models (LLMs) raises concerns regarding their cultural misalignment and potential ramifications on individuals from various cultural norms.

Decentralized Token Economy Theory (DeTEcT)

no code implementations • 15 Aug 2023 • Rem Sadykhov, Geoffrey Goodell, Denis de Montigny, Martin Schoernig, Philip Treleaven

The paper proposes a formal analysis framework for wealth distribution analysis and simulation of interactions between economic participants in an economy.

Machine Learning Modeling to Evaluate the Value of Football Players

no code implementations • 22 Jul 2022 • Chenyao Li, Stylianos Kampakis, Philip Treleaven

This research investigates a new method to evaluate the value of current football players, based on establishing the machine learning models to investigate the relations among the various features of players, the salary of players, and the market value of players.

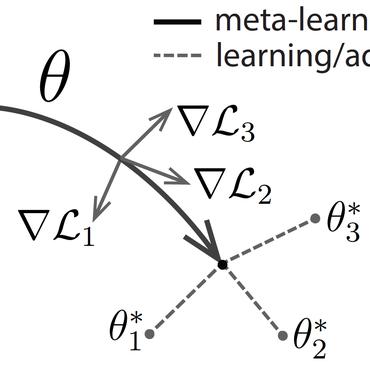

QuantNet: Transferring Learning Across Systematic Trading Strategies

2 code implementations • 7 Apr 2020 • Adriano Koshiyama, Sebastian Flennerhag, Stefano B. Blumberg, Nick Firoozye, Philip Treleaven

The encoder transforms market-specific data into an abstract latent representation that is processed by a global model shared by all markets, while the decoder learns a market-specific trading strategy based on both local and global information from the market-specific encoder and the global model.

Generative Adversarial Networks for Financial Trading Strategies Fine-Tuning and Combination

no code implementations • 7 Jan 2019 • Adriano Koshiyama, Nick Firoozye, Philip Treleaven

Systematic trading strategies are algorithmic procedures that allocate assets aiming to optimize a certain performance criterion.

A Machine Learning-based Recommendation System for Swaptions Strategies

no code implementations • 4 Oct 2018 • Adriano Soares Koshiyama, Nick Firoozye, Philip Treleaven

Derivative traders are usually required to scan through hundreds, even thousands of possible trades on a daily basis.

Twitter Sentiment Analysis: Lexicon Method, Machine Learning Method and Their Combination

no code implementations • 3 Jul 2015 • Olga Kolchyna, Tharsis T. P. Souza, Philip Treleaven, Tomaso Aste

We present a new ensemble method that uses a lexicon based sentiment score as input feature for the machine learning approach.