Search Results for author: Stéphane Crépey

Found 13 papers, 6 papers with code

Spanning Multi-Asset Payoffs With ReLUs

1 code implementation • 21 Mar 2024 • Sébastien Bossu, Stéphane Crépey, Hoang-Dung Nguyen

We propose a distributional formulation of the spanning problem of a multi-asset payoff by vanilla basket options.

An Explicit Scheme for Pathwise XVA Computations

no code implementations • 24 Jan 2024 • Lokman Abbas-Turki, Stéphane Crépey, Botao Li, Bouazza Saadeddine

Motivated by the equations of cross valuation adjustments (XVAs) in the realistic case where capital is deemed fungible as a source of funding for variation margin, we introduce a simulation/regression scheme for a class of anticipated BSDEs, where the coefficient entails a conditional expected shortfall of the martingale part of the solution.

Provisions and Economic Capital for Credit Losses

no code implementations • 15 Jan 2024 • Dorinel Bastide, Stéphane Crépey

Based on supermodularity ordering properties, we show that convex risk measures of credit losses are nondecreasing w. r. t.

Asymptotic Error Analysis of Multilevel Stochastic Approximations for the Value-at-Risk and Expected Shortfall

1 code implementation • 26 Nov 2023 • Stéphane Crépey, Noufel Frikha, Azar Louzi, Gilles Pagès

This article is a follow up to Cr\'epey, Frikha, and Louzi (2023), where we introduced a nested stochastic approximation algorithm and its multilevel acceleration for computing the value-at-risk and expected shortfall of a random financial loss.

Resolving a Clearing Member's Default, A Radner Equilibrium Approach

no code implementations • 4 Oct 2023 • Dorinel Bastide, Stéphane Crépey, Samuel Drapeau, Mekonnen Tadese

When a clearing member defaults, the CCP can hedge and auction or liquidate its positions.

Hedging Valuation Adjustment for Callable Claims

no code implementations • 4 Apr 2023 • Cyril Bénézet, Stéphane Crépey, Dounia Essaket

Darwinian model risk is the risk of mis-price-and-hedge biased toward short-to-medium systematic profits of a trader, which are only the compensator of long term losses becoming apparent under extreme scenarios where the bad model of the trader no longer calibrates to the market.

A Multilevel Stochastic Approximation Algorithm for Value-at-Risk and Expected Shortfall Estimation

1 code implementation • 24 Mar 2023 • Stéphane Crépey, Noufel Frikha, Azar Louzi

We propose a multilevel stochastic approximation (MLSA) scheme for the computation of the Value-at-Risk (VaR) and the Expected Shortfall (ES) of a financial loss, which can only be computed via simulations conditional on the realization of future risk factors.

Beyond Surrogate Modeling: Learning the Local Volatility Via Shape Constraints

1 code implementation • 20 Dec 2022 • Marc Chataigner, Areski Cousin, Stéphane Crépey, Matthew Dixon, Djibril Gueye

We explore the abilities of two machine learning approaches for no-arbitrage interpolation of European vanilla option prices, which jointly yield the corresponding local volatility surface: a finite dimensional Gaussian process (GP) regression approach under no-arbitrage constraints based on prices, and a neural net (NN) approach with penalization of arbitrages based on implied volatilities.

Pathwise CVA Regressions With Oversimulated Defaults

no code implementations • 30 Nov 2022 • Lokman Abbas-Turki, Stéphane Crépey, Bouazza Saadeddine

We consider the computation by simulation and neural net regression of conditional expectations, or more general elicitable statistics, of functionals of processes $(X, Y )$.

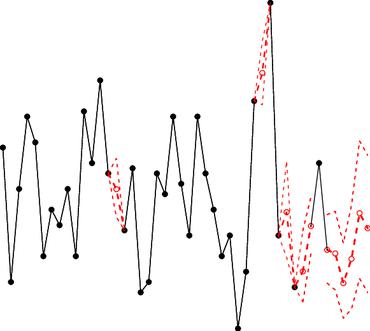

Anomaly Detection on Financial Time Series by Principal Component Analysis and Neural Networks

1 code implementation • 22 Sep 2022 • Stéphane Crépey, Lehdili Noureddine, Nisrine Madhar, Maud Thomas

A major concern when dealing with financial time series involving a wide variety ofmarket risk factors is the presence of anomalies.

Hedging Valuation Adjustment and Model Risk

no code implementations • 24 May 2022 • Claudio Albanese, Cyril Bénézet, Stéphane Crépey

The dynamic hedging theory only makes sense in the setup of one given model, whereas the practice of dynamic hedging is just the opposite, with models fleeing after the data through daily recalibration.

Derivatives Risks as Costs in a One-Period Network Model

no code implementations • 7 Feb 2022 • Dorinel Bastide, Stéphane Crépey, Samuel Drapeau, Mekonnen Tadese

We present a one-period XVA model encompassing bilateral and centrally cleared trading in a unified framework with explicit formulas for most quantities at hand.

Deep Local Volatility

1 code implementation • 20 Jul 2020 • Marc Chataigner, Stéphane Crépey, Matthew Dixon

Deep learning for option pricing has emerged as a novel methodology for fast computations with applications in calibration and computation of Greeks.