Search Results for author: Yada Zhu

Found 22 papers, 9 papers with code

Neural Active Learning Beyond Bandits

no code implementations • 18 Apr 2024 • Yikun Ban, Ishika Agarwal, Ziwei Wu, Yada Zhu, Kommy Weldemariam, Hanghang Tong, Jingrui He

We study both stream-based and pool-based active learning with neural network approximations.

Paraphrase and Solve: Exploring and Exploiting the Impact of Surface Form on Mathematical Reasoning in Large Language Models

1 code implementation • 17 Apr 2024 • Yue Zhou, Yada Zhu, Diego Antognini, Yoon Kim, Yang Zhang

This paper studies the relationship between the surface form of a mathematical problem and its solvability by large language models.

Adversarial Attacks on Fairness of Graph Neural Networks

1 code implementation • 20 Oct 2023 • Binchi Zhang, Yushun Dong, Chen Chen, Yada Zhu, Minnan Luo, Jundong Li

Fairness-aware graph neural networks (GNNs) have gained a surge of attention as they can reduce the bias of predictions on any demographic group (e. g., female) in graph-based applications.

Self-Specialization: Uncovering Latent Expertise within Large Language Models

no code implementations • 29 Sep 2023 • Junmo Kang, Hongyin Luo, Yada Zhu, James Glass, David Cox, Alan Ritter, Rogerio Feris, Leonid Karlinsky

Recent works have demonstrated the effectiveness of self-alignment in which a large language model is, by itself, aligned to follow general instructions through the automatic generation of instructional data using a handful of human-written seeds.

Class-Imbalanced Graph Learning without Class Rebalancing

1 code implementation • 27 Aug 2023 • Zhining Liu, Ruizhong Qiu, Zhichen Zeng, Hyunsik Yoo, David Zhou, Zhe Xu, Yada Zhu, Kommy Weldemariam, Jingrui He, Hanghang Tong

In this work, we approach the root cause of class-imbalance bias from an topological paradigm.

Networked Time Series Imputation via Position-aware Graph Enhanced Variational Autoencoders

no code implementations • 29 May 2023 • Dingsu Wang, Yuchen Yan, Ruizhong Qiu, Yada Zhu, Kaiyu Guan, Andrew J Margenot, Hanghang Tong

First, we define the problem of imputation over NTS which contains missing values in both node time series features and graph structures.

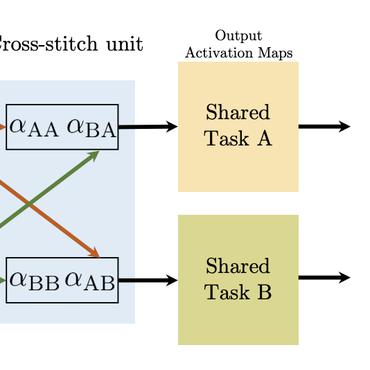

Mastering Long-Tail Complexity on Graphs: Characterization, Learning, and Generalization

no code implementations • 17 May 2023 • Haohui Wang, Baoyu Jing, Kaize Ding, Yada Zhu, Wei Cheng, Si Zhang, Yonghui Fan, Liqing Zhang, Dawei Zhou

To bridge this gap, we propose a generalization bound for long-tail classification on graphs by formulating the problem in the fashion of multi-task learning, i. e., each task corresponds to the prediction of one particular class.

FairGen: Towards Fair Graph Generation

no code implementations • 30 Mar 2023 • Lecheng Zheng, Dawei Zhou, Hanghang Tong, Jiejun Xu, Yada Zhu, Jingrui He

In addition, we propose a generic context sampling strategy for graph generative models, which is proven to be capable of fairly capturing the contextual information of each group with a high probability.

Fairness-aware Multi-view Clustering

1 code implementation • 11 Feb 2023 • Lecheng Zheng, Yada Zhu, Jingrui He

We also derive insights regarding the relative performance of the proposed regularizers in various scenarios.

STERLING: Synergistic Representation Learning on Bipartite Graphs

no code implementations • 25 Jan 2023 • Baoyu Jing, Yuchen Yan, Kaize Ding, Chanyoung Park, Yada Zhu, Huan Liu, Hanghang Tong

Most recent bipartite graph SSL methods are based on contrastive learning which learns embeddings by discriminating positive and negative node pairs.

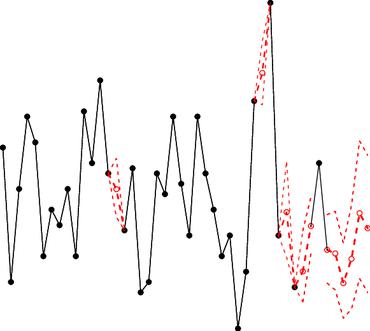

Retrieval Based Time Series Forecasting

no code implementations • 27 Sep 2022 • Baoyu Jing, Si Zhang, Yada Zhu, Bin Peng, Kaiyu Guan, Andrew Margenot, Hanghang Tong

In this paper, we show both theoretically and empirically that the uncertainty could be effectively reduced by retrieving relevant time series as references.

ARIEL: Adversarial Graph Contrastive Learning

1 code implementation • 15 Aug 2022 • Shengyu Feng, Baoyu Jing, Yada Zhu, Hanghang Tong

In this work, by introducing an adversarial graph view for data augmentation, we propose a simple but effective method, Adversarial Graph Contrastive Learning (ARIEL), to extract informative contrastive samples within reasonable constraints.

COIN: Co-Cluster Infomax for Bipartite Graphs

no code implementations • 31 May 2022 • Baoyu Jing, Yuchen Yan, Yada Zhu, Hanghang Tong

We theoretically prove that COIN is able to effectively increase the mutual information of node embeddings and COIN is upper-bounded by the prior distributions of nodes.

Adversarial Graph Contrastive Learning with Information Regularization

1 code implementation • 14 Feb 2022 • Shengyu Feng, Baoyu Jing, Yada Zhu, Hanghang Tong

Contrastive learning is an effective unsupervised method in graph representation learning.

Multi-Domain Transformer-Based Counterfactual Augmentation for Earnings Call Analysis

no code implementations • 2 Dec 2021 • Zixuan Yuan, Yada Zhu, Wei zhang, Ziming Huang, Guangnan Ye, Hui Xiong

Earnings call (EC), as a periodic teleconference of a publicly-traded company, has been extensively studied as an essential market indicator because of its high analytical value in corporate fundamentals.

On Sample Based Explanation Methods for NLP: Faithfulness, Efficiency and Semantic Evaluation

no code implementations • ACL 2021 • Wei zhang, Ziming Huang, Yada Zhu, Guangnan Ye, Xiaodong Cui, Fan Zhang

In the recent advances of natural language processing, the scale of the state-of-the-art models and datasets is usually extensive, which challenges the application of sample-based explanation methods in many aspects, such as explanation interpretability, efficiency, and faithfulness.

On Sample Based Explanation Methods for NLP:Efficiency, Faithfulness, and Semantic Evaluation

no code implementations • 9 Jun 2021 • Wei zhang, Ziming Huang, Yada Zhu, Guangnan Ye, Xiaodong Cui, Fan Zhang

In the recent advances of natural language processing, the scale of the state-of-the-art models and datasets is usually extensive, which challenges the application of sample-based explanation methods in many aspects, such as explanation interpretability, efficiency, and faithfulness.

Heterogeneous Contrastive Learning

1 code implementation • 19 May 2021 • Lecheng Zheng, JinJun Xiong, Yada Zhu, Jingrui He

We first provide a theoretical analysis showing that the vanilla contrastive learning loss easily leads to the sub-optimal solution in the presence of false negative pairs, whereas the proposed weighted loss could automatically adjust the weight based on the similarity of the learned representations to mitigate this issue.

Network of Tensor Time Series

1 code implementation • 15 Feb 2021 • Baoyu Jing, Hanghang Tong, Yada Zhu

We propose a novel model called Network of Tensor Time Series, which is comprised of two modules, including Tensor Graph Convolutional Network (TGCN) and Tensor Recurrent Neural Network (TRNN).

Reinforcement-Learning based Portfolio Management with Augmented Asset Movement Prediction States

1 code implementation • 9 Feb 2020 • Yunan Ye, Hengzhi Pei, Boxin Wang, Pin-Yu Chen, Yada Zhu, Jun Xiao, Bo Li

Our framework aims to address two unique challenges in financial PM: (1) data heterogeneity -- the collected information for each asset is usually diverse, noisy and imbalanced (e. g., news articles); and (2) environment uncertainty -- the financial market is versatile and non-stationary.

Task-Based Learning via Task-Oriented Prediction Network with Applications in Finance

no code implementations • 17 Oct 2019 • Di Chen, Yada Zhu, Xiaodong Cui, Carla P. Gomes

Real-world applications often involve domain-specific and task-based performance objectives that are not captured by the standard machine learning losses, but are critical for decision making.

PAGAN: Portfolio Analysis with Generative Adversarial Networks

no code implementations • 19 Sep 2019 • Giovanni Mariani, Yada Zhu, Jianbo Li, Florian Scheidegger, Roxana Istrate, Costas Bekas, A. Cristiano I. Malossi

Sound financial theories demonstrate that in an efficient marketplace all information available today, including expectations on future events, are represented in today prices whereas future price trend is driven by the uncertainty.

Computational Finance Statistical Finance